- Last Money In - Newsletter on Venture Capital Syndicates

- Posts

- The Context Missing in AI Valuations

The Context Missing in AI Valuations

a newsletter about VC syndicates

The Context Missing in AI Valuations

Disclosure: The author and/or affiliated entities maintain investment positions in multiple companies referenced in this analysis. Nothing herein constitutes investment advice or a recommendation to buy or sell any security.

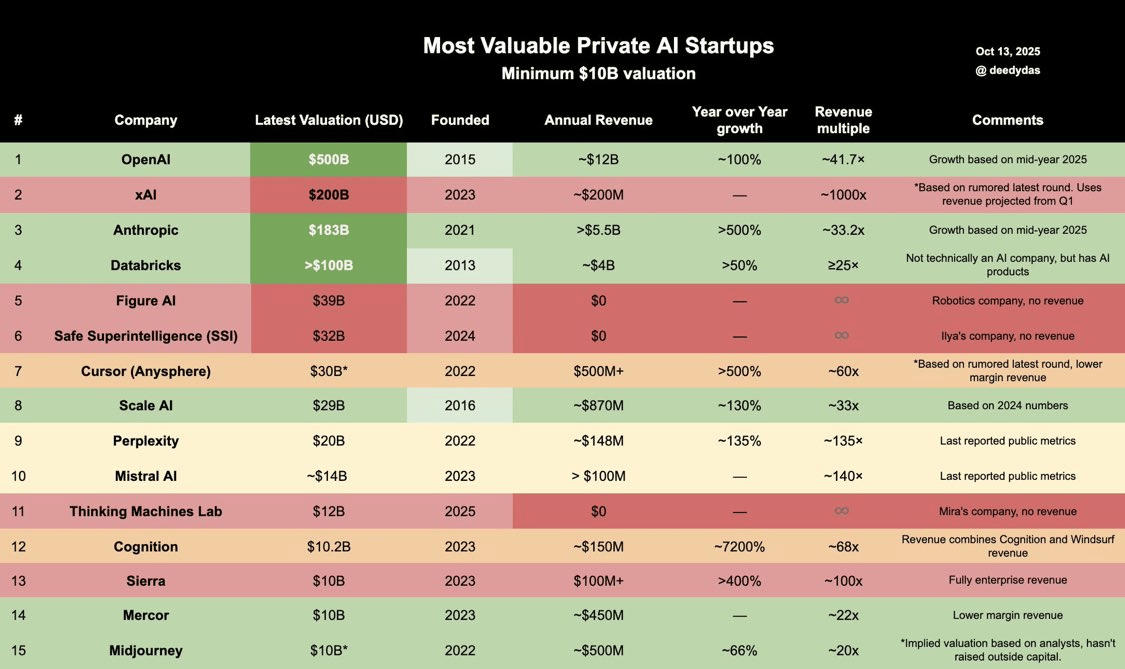

An investor from Menlo Ventures put out a chart this month comparing the valuations of the highest-valued AI companies relative to their metrics—mainly revenue and year-over-year growth. What this chart does well is provide a snapshot of which companies are likely overvalued or undervalued relative to peers, and candidly, I think that's all it was trying to do. But as with all valuations, there's much more to decipher to understand what's actually overvalued or undervalued. Let's dig into some of these metrics and qualitative factors.

Next 12 Months Revenue Growth

Let's start with expected next 12 months revenue growth. It's common for investors to normalize revenue multiples by making them forward-looking—if we adjust for next 12 months growth, how do the multiples of similar businesses compare? Seems fair, right? If two companies have equal valuations with the same revenue, but one is expected to grow 2x faster next year, that business should command a premium. Next twelve months growth rates help normalize this.

Having historical growth rates helps, but very few people are doing the math on next year's growth to make the adjustment on forward-looking revenue multiples. I have no insider info here, but if Perplexity, as one example, planned in their forecast to aggressively monetize ad space within their search, perhaps the next 12 months revenue growth would be so large that its forward-looking multiple would actually look cheap on a relative basis to other AI comps. Ultimately we need that data and be able to do that diligence to get a more accurate snapshot.

🚀 We're Hiring: Membership Lead (Tier 1 VC-Backed Investment Platform)

We're building something rare—an invite-only investment platform for executives and family offices. And we need someone exceptional to build and execute membership strategy from day one.

The opportunity: Shape how we grow, engage, and retain our founding members. You'll own the full member journey—from first touch to long-term engagement—working directly with our founding team to build a network.

You're the right fit if you:

Have 7-10 years building communities or managing relationships in high-touch, investment-focused environments

Know how to cultivate relationships with executives, investors, and family offices

Thrive in zero-to-one environments and get energized by ambiguity

Can craft narratives that resonate with sophisticated audiences

Are analytical, adaptable, and ready to build something exceptional

What you'll do: Lead member acquisition, onboarding, and retention strategy. Develop communications and feedback loops. Collaborate on partnerships, branding, and go-to-market. Build and manage a small team. Drive measurable engagement and growth.

The details: Based in LA (or SF/NY/MIA with some LA travel). Competitive salary + equity. Direct access to our Tier 1 VC network and founding team.

Ready to build with us? Email your resume to [email protected] with subject line: "Membership Lead - [Your Name]"

Gross Margins

It's sort of funny just how much we've round-tripped the 2021 boom. Anyone who was part of that market remembers growth at all costs was prioritized over profitability—almost everyone ignored profitability for growth. Then things did a 180 in 2022-2023, and profitability became more important than growth. And now we're back to growth at all costs.

This is where gross margins come into play. For many of the AI coding companies like Cursor, gross margins being very low are being discounted pretty heavily with most expecting they will expand over time. There's one side of the table that looks at businesses like Snowflake—which reported negative gross margins in its early growth stages due to high costs of cloud infrastructure and customer acquisition, but achieved solid, high gross margins (60%+ by IPO) once scale and efficiency improved. That's the good case. On the other end, there are companies like Toast that started with low gross margins and still maintain them today.

Why does this matter for valuation multiples? Investors pay up for margin expansion potential. A company trading at 20x revenue with 30% gross margins and a path to 70% is fundamentally different from one trading at the same multiple with 30% gross margins stuck there permanently. The former suggests leverage, expansion opportunities and pricing power; the latter suggests structural cost issues that persist at scale. But in any case two of the same companies with equal revenue but different margin profiles deserve different valuations.

Moats & TAM

Revenue defensibility determines whether today's growth compounds into tomorrow's dominance or evaporates into churn. The AI landscape reveals stark contrasts in competitive positioning that justify—or expose—valuation gaps.

Not all AI revenue is created equal. Enterprise infrastructure plays exhibit fundamentally different retention economics than developer tools or consumer applications:

Infrastructure layer (cloud platforms, data warehouses): Once embedded in a company's stack, switching costs are higher. Migration risk, data gravity, and integration dependencies create 120%+ net revenue retention as customers expand usage. Databricks and Snowflake demonstrated this pattern—initial workloads expand across teams and use cases organically.

Developer tooling (coding assistants, IDEs) on the other hand maintains lower switching costs with mean retention hinging on sustained product superiority. Cursor's rapid rise shows how quickly developers will migrate. These companies need continuous innovation to maintain position.

The valuation implication: two companies with identical $500M ARR deserve completely different multiples if one has 140% NRR with enterprise contracts versus 95% NRR in a commoditized market.

The TAM Trap —> The humanoid robotic company's multi-billion dollar valuation with minimal commercialization echoes the 2021 playbook that burned capital in vertical farming, hyperspeed planes, and other "trillion-dollar TAMs." The pitch is seductive: humanoid robotics could be a $10 trillion market, therefore even 1% share justifies today's price.

The problems with TAM-driven valuation: Capital intensity as moat—or millstone: Yes, robotics requires billions in R&D that competitors must match. But capital intensity only becomes a moat after you achieve technical and commercial success. Before that inflection point, it's just burn with binary outcomes. Waymo spent $10B+ to reach limited autonomous deployment; many competitors spent billions to reach nothing.

The largest markets also attract the most competition. AI infrastructure faces competition from hyperscalers (Google, Microsoft, Amazon) with deeper pockets and existing distribution. When Tesla and others are competing in humanoid robotics alongside startups, being early or well-funded guarantees nothing.

Unit Economics & Efficiency

Here's another area where the narrative gets interesting: burn multiples—a key indicator of capital efficiency—are arguably pretty strong today for many AI hyperscalers, at least for now.

Anthropic has reportedly burned around $9B (+/-) to date to achieve almost $6B in ARR. That's a burn multiple of roughly ~1.5x—not bad at all. Same with Databricks, which is reportedly at $4B ARR but has burned under that amount in total capital.

David Sacks defines a "good" burn multiple as less than 2x, meaning a startup burns less than $2 to generate $1 of net new ARR. An excellent or "best-in-class" burn multiple is below 1x, where each dollar burned results in at least a dollar of new ARR, indicating strong capital efficiency. Anything above 2x is considered suspect or inefficient unless justified by unusual circumstances or market dynamics.

By this standard, many of the leading AI companies are actually showing impressive capital efficiency despite the billions being deployed. The question is whether this efficiency and defensibility persists as competition intensifies and customer acquisition costs inevitably rise, or whether we're in a temporarily efficient window where early-mover advantages and product-market fit are masking what will become more expensive growth or churn later.

The Zero-Revenue Multi-Deca Billion Frontier

Then there's the most extreme end of the spectrum: zero-revenue companies commanding multi-billion dollar valuations.

Safe Superintelligence's reported $32B valuation represents uncharted territory—there's simply no precedent for this ever. Even Anthropic's Series C at a $4B-$5B valuation with zero revenue seemed absurd at the time, and while it worked out extremely well for those investors, SSI is asking investors to pay 8x that premium for even less.

At some point, the price has to matter. You're buying a call option on a single team's ability to hit a $100B+ valuation, with no to limited product validation and no to limited market traction. The absurdity of this price is still impossible for many to justify even if Meta will pay a near equivalent amount in an acquihire of them.

To Conclude

Ultimately, comparing AI valuations requires more nuance than a simple revenue multiple chart can provide. The companies that look expensive today might be cheap on a forward basis if growth accelerates. Those with low gross margins might expand them at scale—or might not. Strong burn multiples suggest capital efficiency, but only if that efficiency holds as markets mature and CAC rises. The real question isn't who's overvalued today, but who has the combination of growth, margins, efficiency, and defensibility to justify a much higher valuation several years from now. That's the analysis worth doing.

If you enjoyed this article, feel free to view our prior posts on adjacent topics