- Last Money In - Newsletter on Venture Capital Syndicates

- Posts

- 🤝Jeremy Terman: DoorDash IPO → Investor & Operator, unique Approach to Landing past 2 Roles

🤝Jeremy Terman: DoorDash IPO → Investor & Operator, unique Approach to Landing past 2 Roles

a newsletter about VC syndicates

Last Money in is Powered by Sydecar

Sydecar is a frictionless deal execution platform for emerging venture investors. We make it easy for anyone to launch SPVs and funds in minutes, with automated banking, compliance, contracts, tax, and reporting so that customers can focus on making deals and building relationships.

🤝Jeremy Terman: DoorDash IPO → Investor & Operator, unique Approach to Landing past 2 Roles

Who are the outside the box Syndicate GP’s/LP’s and how do they think about allocating capital via SPV’s?

Jeremy Terman is the Director of Mid-Market at 7shift. He oversees a team of 15 that manages the full customer lifecycle of pre-sale, franchise sales, implementation, and account management for any restaurant brand with 10 or more locations. Before 7shifts Jeremy worked for other early stage startups in the restaurant industry like Pocket Points and Lunchbox, and he made his name as an early DoorDash employee. Jeremy built his career in sales as one of the early DoorDash outside sales reps that launched over 15 markets, and throughout his career he sold DoorDash to thousands of local businesses. Leading up to DoorDash’s IPO, Jeremy negotiated $2B in national contracts.

After DoorDash’s IPO, Jeremy shifted his focus into angel investments. Jeremy became a partner with DashAngels, a syndicate of DoorDash alumni, where they have invested over $12.5M in 42 companies over the past two and a half years. After investing in 20 companies and fundraising $1.7M for his professional esports organization,he realized he could assist founders with fundraising and go-to-market strategy, leading to the creation of Terman Capital Partners. Jeremy’s future plan is to establish his own fund, concentrating on marketplace and SaaS companies, where he'll use his fundraising, operational, and investing skills to guide them toward successful exits.

Our interview with Jeremy Terman below:

How did you learn about angel investing and learn to make your first investment?

Upon DoorDash’s filing of its S1 for IPO, I embarked on a journey to explore avenues for diversifying my equity portfolio. Guided by a few mentors, I learned about angel investing among other ways to diversify my investment in the market. During my research, I discovered Angellist and the concept of syndicate investing. I learned I didn’t have to spend $50k to invest in a company, I could invest as little as $1,000 in a deal. This learning and research led to applying to a few syndicates. After seeing dozens of deals, I finally pulled the trigger and made my first investment in Photon Commerce. This then led to 20 other investments over the last 2 years through Angellist. Through these deals, I have had 2 failures, 1 acquisition and 1 follow on round with my favorite investment, Genetica, an AI software focused on inventory management and guest experience in the cannabis industry.

When you started learning about the variety of investment vehicles, where else did you allocate?

Direct investments: I set a hard dollar amount of what I’d be willing to diversify into more “risky” opportunities and this led to direct investment. I directly invested in 5 companies, one of them being one of the initial checks at Genetica.

Fund investments: as I invested in the syndicate deals, I learned more about funds and how to become an LP in a fund. Since there are management fees with the funds and capital calls, it is a more intense process. I invested in two funds: Looking Glass Capital and Red Rose Capital - in the health, climate, and environment; and web3 sectors where I had low exposure in my day to day investments and syndicate deals.

How did you become a partner at DashAngels?

When I was learning about angel investing, one of my DoorDash co-workers, Sameed Musvee, reached out to me about becoming an LP. When I realized we had DoorDash alumni investing in companies and helping founders build and scale their companies, I noticed they did not have a sales leader as a partner. Founders always need help in sales: hiring sales leadership, sales process, sales enablement, go to market, goaling, etc. I knew I could position myself as an expert to help the portfolio founders with sales and go to market, but I could also help recruit and educate my network to join as LPs. Utilizing your network to help build and scale any business or syndicate is valuable and that is how I worked to gain the trust to become a partner at DashAngels.

While a partner at DashAngels, you were able to drive an investment at Lunchbox during its Series B. Walk through how being part of a syndicate helped your business at that time?

I joined Lunchbox in Q3 of 2021 and part of the reason for joining was the vision of raising our Series B being part of the same hypergrowth I had just experienced at DoorDash. Towards the end of the year, we had Coatue ready to lead our round along with follow ons from Primary and 645 Ventures and I went to Nabeel and shared that DashAngels could be a potential fit in the round.

Part of Lunchbox’s vision was to enable restaurants to build powerful 1st party digital ordering to convert 3rd party delivery consumers and having DoorDash alumni/syndicate invest in this vision would be incredible. Not only were we able to raise the capital, but 2 other DoorDash alumni joined the sales team as well.

DashAngels participated in 7shifts Series C and 6 months later you end up working at 7shifts with 2 other former DoorDash leaders. Can you walk through this?

As I shared earlier, my pitch to the DashAngels team was that founders always need help with sales. So in one of our quarterly conversations with the CEO of 7shifts, we discussed his need to find a new sales leader for SMB. I referred my first boss at DoorDash who helped scale the outside sales team and not long after, she was hired. Not even a few months go by and the CEO reaches out sharing that he is looking for a new VP Sales and Director of Mid-Market. I referred the former leader of a 50+ person enterprise post-sale division at DoorDash for VP of Sales. Shortly after he accepts the role, I go through the interview process and am hired for the Director of Mid-Market.

2 key lessons here:

Find the best operators, sales leaders, revenue operations, marketing, etc. co-workers and build strong relationships with them. Not only for making your day-to-day easier, but finding the right formula and team chemistry can drive success throughout a career and can be replicated at multiple businesses.

Being an investor in 7shifts and having access to the executive team opened up an opportunity for a job for a couple of my colleagues, but also myself and that is the power of being part of a syndicate group.

What advice would you give other operators on getting started in angel investing/syndicates?

You control your own risk levels and the risk level can be low. You can see hundreds of deals and still not make a single investment. It’s like reading a book, but it’s pitch decks. The more you read, the more you see what you like and don’t like. Similarly, it’s like buying a car. You search for the make, model, color… In angel investing you find the industry, company, and founder(s) you like and can invest as low as $1,000. In addition to following a company's journey, there are opportunities to meet other investors in the company or syndicate. You never know whom you can meet, and this puts you in a select group of folks who have similar if not greater access to capital and are willing to take risks similarly to yourself.

What excites you most about angel investing?

I am a builder at heart and love watching a company, team and individual grow. In the startup world, growth is so immediate and tangible that you can see a company change drastically month over month. Being a part of that, regardless of check size, knowing my capital and input is helping the founders and teams make their dreams happen is just so rewarding. From a financial perspective, angel investing can provide life changing returns.

How has angel investing made you a better operator?

As a Director at a Series C company in 2024, focusing on profitability and sustainable growth is crucial. Since I see 100s of deals, talk monthly with founders, and hear where they are focused and spending their time on, helps me learn how to talk with my teams at 7shifts. Direct interactions with founders and exposure to other companies' growth plans provide me with valuable, diverse perspectives.

How many deals a year do you plan to invest in?

My wife and I just had our first child last year and have taken a back seat to new investments. As we balance out our life as a family, I’d like to invest in 5-10 companies per year combined in both syndicates and direct investments. I prefer to invest in the seed and series A rounds.

As an investor, what is your goal a decade from now?

Over the next decade I want to be part of 3 additional exits as an operator. I have worked at every stage company and love operating at Series B or scale-ready companies with $10m in revenue and product-market fit.. I have found that I love investing and consulting with founders in the pre-seed to Series A stages, and I love operating in businesses Series B and beyond. Once I have those exits, I plan to build either a fund or syndicate where I work with founders daily and have my consulting practice, Terman Capital Partners, fully active as well.

Carta exits secondary trading following credibility hit

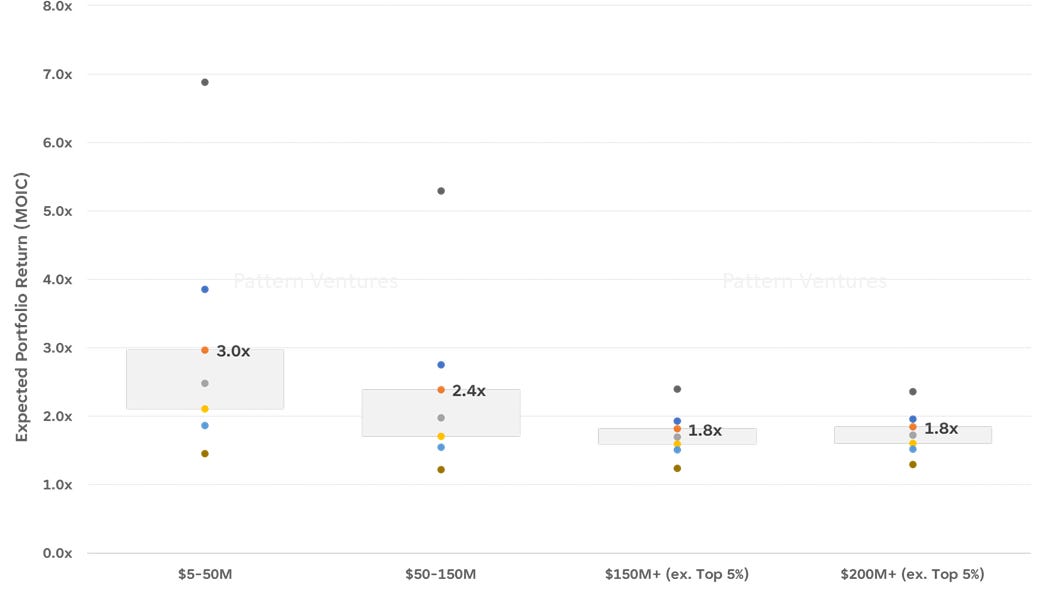

Pattern Ventures on the Appeal of Small Venture Funds

Ben Zises on the longest game founders will ever play

Last Money In is Powered by Sydecar

Sydecar is a frictionless deal execution platform for emerging venture investors. We make it easy for anyone to launch SPVs and funds in minutes, with automated banking, compliance, contracts, tax, and reporting so that customers can focus on making deals and building relationships.

How did you like this weeks topic? |

If you enjoyed this post, please share on LinkedIn, X (fka Twitter), Meta and elsewhere. It goes a long way to support us!

We’ll be back in your inbox next Wednesday on our next topic. Thanks for tuning in!

Questions? Comments? Feedback? We welcome all, and would love to hear from you!