- Last Money In - Newsletter on Venture Capital Syndicates

- Posts

- Is Polymarket Worth $10 Billion? The Math Says No

Is Polymarket Worth $10 Billion? The Math Says No

a newsletter about VC syndicates

Last Money in is Powered by Sydecar

Sydecar empowers syndicate leads to manage their investments more effectively. Organize, manage, and engage your investor network effortlessly with Sydecar’s management and communication tools. Their platform also automates banking, compliance, contracts, tax, and reporting, freeing up syndicate leads to focus on securing deals and strengthening investor relations. Elevate your syndicate operations with Sydecar.

Is Polymarket Worth $10 Billion? The Math Says No

Disclaimer: This content is for informational purposes only and should not be construed as investment advice. The author has no financial interest in Polymarket. Readers should conduct their own research and consult qualified financial professionals before making investment decisions.

Polymarket is a decentralized, blockchain-based prediction market platform where users buy and sell shares on the outcome of real-world events like elections, sports, and economic indicators. Share prices reflect the collective crowd's estimate of the probability that an event will occur.

The platform's importance in the ecosystem stems from being arguably the first company to take prediction markets mainstream, successfully enabling crowd-sourced forecasting to generate real-time probabilities for future outcomes—often outperforming traditional polling or expert analysis in both accuracy and speed.

When the company gained significant traction in October-November 2024 (around the US presidential election), it was achieving well over $2 billion in monthly wagers with over 80% market share. Fast forward a year, and the landscape has dramatically shifted with volumes, MAUs and market share all declining rapidly. Polymarket has now raised over $100 million, and there's an argument that the liquidation preference may soon be worth more than the Company itself…. While it's rumored to be raising at a $10 billion valuation, my guess is that if this happens it will be insider-led and/or will lead to significant exit liquidity. So let’s get into it.

Last Money In Deals: We have made over 800 startup investments. Accredited investors & qualified purchasers within the LMI community can now gain access to our alternative investments such as venture, late-stage growth, and private equity through our deal flow sheet. Interested (it's completely free): Fill out this form.

🐦 Follow Us: Visit Alex’s Linkedin and Zach’s X account for constant updates Exclusive data from Sydecar, one of the industry's leading fund administrators, quantifies this transformation.

The Numbers Tell a Troubling Story

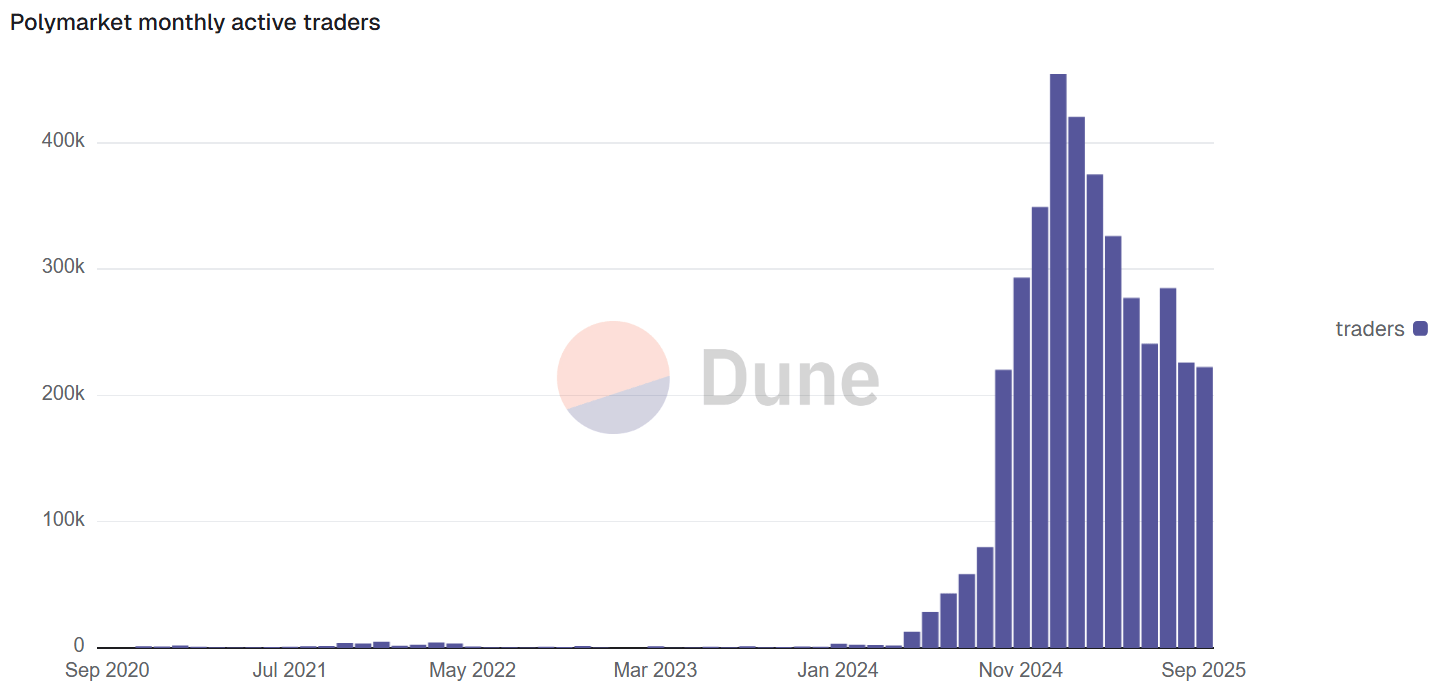

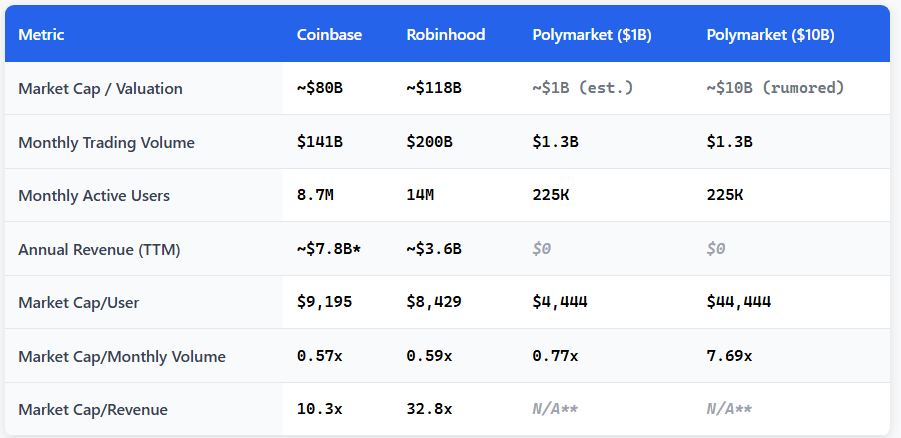

According to Dune Analytics, active traders on Polymarket have declined from 400,000+ monthly at peak to around 225,000 today. To put this in perspective, Coinbase has approximately 8.7 million monthly transacting users and Robinhood has over 14 million—making Polymarket roughly 2.5% and 1.6% of these platforms' user bases respectively, and declining as a relative percentage.

The trading volume comparison is also concerning.

Polymarket's monthly volume has dropped from a $2.5 billion peak to approximately half that (~$1.3 billion) currently. By comparison, Coinbase processes around $141 billion in monthly trading volume (making Polymarket less than 1% of Coinbase's volume) and Robinhood handles over $200 billion monthly for equities trading (again, Polymarket represents less than 1% of Robinhood's volume).

Revenue comparison? According to public reports, Polymarket isn't generating any revenue.

But this isn’t a fair comparison —let's compare these businesses on a valuation-adjusted basis.

At $1B, the valuation math works—kind of. Polymarket trades at a discount per user and roughly matches Coinbase and Robinhood on market cap-to-volume ratios. Polymarket’s zero revenue is concerning, but for early-stage platforms, investors typically bet on the ability to flip the monetization switch once scale is achieved, and I can buy into that.

The problem? Polymarket isn't growing —it's losing share and its metrics are worsening. When a company is bleeding users and market share, the "we'll monetize later" argument and “grow into our valuation” becomes much harder to justify. High-growth companies earn the benefit of the doubt on revenue timing; declining companies often do not.

At $10B, the math breaks entirely. Polymarket would trade at ~$44k per monthly active user versus $8,400-$9,200 for profitable competitors like Coinbase and Robinhood. You're paying a 5x premium for a company that's:

Bleeding users (400K → 225K)

Hemorrhaging market share (80% → sub-40%)

Generating zero revenue

Facing intensifying competition

This isn't a "massive TAM" story when the company's competitive moats are eroding in real-time.

Competitive Pressure Intensifying

But let’s give Polymarkets some benefit as prediction markets are cyclical—just like the crypto and trading platforms they're often compared to. Coinbase and Robinhood have both experienced dramatic swings in trading volume and valuations and found their way out, so context matters.

This begs the question: how is Polymarket actually performing relative to competitors?

Unfortunately, the competitive reality isn’t great.

Kalshi / Robinhood are starting to decimate Polymarket's market share, surging from just 3.1% a year ago to over 60% today. According to recent Ark Research, Robinhood and Kalshi now control approximately two-thirds of the prediction market—up from an estimated 10% combined just twelve months ago. Meanwhile, Polymarket's market share continues to erode with no signs of stabilization.

This isn't just a temporary dip during a slow news cycle—until proven otherwise, it's a fundamental shift in market dynamics that raises serious questions about Polymarket's competitive positioning and the long-term viability of its equity.

The classic tech question applies here: can the incumbent build product faster than the entrant builds distribution? The answer appears to be no. Robinhood has already built prediction markets and captured significant share, partnering with Kalshi to devastating effect for Polymarket.

This is just the beginning. New entrants are flooding in— while established platforms like Crypto.com are partnering with sports betting companies like Underdog Sports to enter the space. More concerning for Polymarket: companies with massive existing distribution are still sitting on the sidelines.

DraftKings alone has 5+ million active users and deep sports betting infrastructure. When they inevitably enter prediction markets, they'll bring both product sophistication and enormous distribution advantages that Polymarket can't match. The same applies to other major players with built-in user bases and regulatory relationships.

Polymarket isn't just fighting for market share—it's racing against time before companies with 10x their distribution power decide this market is worth pursuing. At current growth trajectories, that race looks increasingly difficult.

Valuation Reality Check

Polymarket has value—but at what price? The math suggests $1 billion (Founders Fund's recent valuation) represents probably something close to fair value today, not the $10 billion being whispered in secondary markets.

When a company has declining market share, shrinking metrics, and zero revenue, even the $1 billion valuation requires significant optimism about future turnaround potential.

Why This Matters for Investors

I'm not writing this to criticize Polymarket—I genuinely hope they widely succeed and clearly have a path to do so. But this article is about price, and with VCs and syndicators actively marketing this opportunity at nearly 10x what fundamentals support, the fair value of the business deserves a conversation.

***Polymarket absolutely could turn things around quickly.

Token incentives could reignite growth

A DraftKings, Kraken or other partnership could transform their distribution as Kalshi achieved with Robinhood

I have no doubt that this is on their mind and if I had to make a binary bet, I would bet a partnership like this does happen.

But the reality is that Polymarket's supposed competitive advantages—brand recognition and network effects—are proving far more fragile than their valuation suggests. When Kalshi can steal 60% market share in twelve months, those "moats" look more like speed bumps.

At $1 billion, there’s a good argument that it's a reasonable bet on a company with proven product-market fit and market leading brand in an exciting, large space. At $10 billion, it’s hard to say you’re investing — it feels far more like speculating on a best-case scenario that current fundamentals don't support.

IMPORTANT DISCLAIMERS:

This content is for informational and educational purposes only and should not be construed as investment advice. The author is not a licensed investment advisor and has no financial interest, position, or investment in Polymarket.

All investments carry risk, including potential loss of principal. The information presented is based on publicly available data and may contain errors or omissions. Market conditions and company fundamentals can change rapidly. This analysis represents the author's personal opinions and should not be relied upon as the sole basis for any investment decision.

Readers should conduct their own research and consult with qualified financial professionals before making any investment decisions.

If you enjoyed this article, feel free to view our prior posts on adjacent topics