- Last Money In - Newsletter on Venture Capital Syndicates

- Posts

- Balaji’s New 506(c) Fund → Massive Step in Democratizing Venture Capital

Balaji’s New 506(c) Fund → Massive Step in Democratizing Venture Capital

a newsletter about VC syndicates

Last Money in is Powered by Sydecar

Sydecar is a frictionless deal execution platform for emerging venture investors. We make it easy for anyone to launch SPVs and funds in minutes, with automated banking, compliance, contracts, tax, and reporting so that customers can focus on making deals and building relationships.

Early Bird Pricing for Deal Sheet Ends March 1st!

Curated & Discounted SPVs directly to your inbox

Deal Sheet is a paid weekly newsletter that directly delivers the best startup investment opportunities weekly. These deals are being syndicated by 20+ of the best and most active syndicate leads we’ve worked with. All Deal Sheet deals include discounted carry (10% carry versus standard 20%).

Early bird pricing of $2,000 ends on March 1st and will be going up, so join now if considering!

Last week Deal Sheet subscribers received investment opportunities with co-investors General Catalyst, Lightspeed, Kleiner Perkins, L Catterton, Microsoft (M12) & others.

Balaji’s 506(c) Fund & Why This is a Massive Step in Democratizing Venture Capital

Just a few weeks ago Balaji S. Srinivasan launched the Balaji Fund before it had raised the capital and closed the fund. This is considered a 506(c) fund (an alternative to Rule 506(b)) which means you can raise your fund in public and leverage press in advance to help attract Limited Partners to invest. You can read about the fund here.

I believe Balaji’s Fund will open the doors to a new breed of investors interested in his thesis but also Venture Capital in general. More on this at the end.

Balaji is a well-positioned GP to raise a fund having been the CTO of Coinbase and a General Partner at Andreessen Horowitz, but it is unusual to raise a 506c fund as most are not done at this size.

In this blog post we will cover the following:

Define & explore the differences & benefits of 506(c) versus 506(b)

Why Balaji is well positioned to raise a $50m+ fund in the 506(c) structure

Examples of smaller VC’s/Funds that have raised under 506(c) & why they did it

Our take on what this means for the future of Venture Capital

We’d like to thank venture capital lawyer Chris Harvey of Harvey Esquire for his support on this article!

I also quote this Signature Block (Ryan Hoover) great recent piece titled A better way to raise your fund a few times throughout this article.

High-Level Summary of the differences between a 506(c) & 506(b) fund:

In short, a 506(c) fund means you can advertise and generally solicit to anyone, while a 506(b) offering must be limited to private fundraising. You can think about the difference in the ability to leverage the public or not. Under 506(c), you can advertise your fund on a large billboard or even a Super Bowl TV ad, while Rule 506(b) is more restrictive, like a private club with a member’s only invite.

According to AngelList:

506(b) Guidelines: For 506(b) funds, you must not engage in any practice which might be viewed as “general solicitation” or “advertising” of the interests in your fund.

506(c) Guidelines: 506(c) funds may engage in general solicitation and advertising (of note, most Rolling Funds are 506(c) funds so they can post about their fund offering on LinkedIn or X.com).

However, there is more to explain here, so let’s dive in.

So, what are the Benefits of a 506(c) fund?

Compared to both private funds under Rule 506(b) and publicly-traded venture funds (such as ARK Venture Fund), raising capital under Rule 506(c) of Regulation D offers several unique benefits:

Enhanced Access to Capital

You get access to a broader investor pool → 506(c) allows general solicitation and advertising, opening doors to a wider pool of capital/potential LP’s (with certain income or net worth qualifications) outside their network. This can significantly expand your potential investor base and increase the amount of capital you can raise.

Reduced reliance on networks → with the ability to publicly promote your fund, you're not solely reliant on pre-existing relationships within your network. This can be particularly advantageous for new or emerging fund managers looking to build their portfolios.

Reduced time to raise your fund → ideally leveraging general solicitation you can reach LPs quicker and more broadly which in turn will reduce your time to raise your fund, and general time spent fundraising.

Increased Marketing and Branding:

Publicity and Awareness → You can actively market your fund through websites, social media, press releases, and other channels, building brand recognition and generating investor interest. This can be highly valuable for attracting a diverse pool of investors and differentiating yourself from other funds.

Cost-effective Marketing → Compared to the potentially high costs of targeting individual accredited investors, utilizing public channels can be a more cost-effective way to reach a wider audience.

Greater Flexibility and Agility:

Tailored Investor Communication → Unlike the voluminous disclosures required for publicly traded funds, you can design and tailor your marketing materials and communications to resonate with your specific target audience, investment strategy and risks.

Faster Deployment of Capital → The streamlined regulatory process compared to public offerings allows for quicker fundraising and deployment of capital into target investments.

To put it clearly, if you’re relying on the traditional way to raise a 506(b) fund, you CANNOT use general solicitation. Seemingly innocuous things like an internet post or dropping your fund’s investment terms at a seminar or meetings where the audience was invited via a general solicitation would be considered general solicitation, and this cannot be done by traditional 506(b) funds. You have to avoid general solicitation and refrain from advertising or publicizing in venues that include people you do not personally know or have a pre-existing relationship with.

Based on the Benefits, who is 506(c) for?

In my opinion, there are certain GP types that may have a strategic advantage in going the 506(c) route similar to Balaji. Here are a few types that I think would be well-positioned to explore the 506(c) route:

GPs that have built strong personal brands → Those who have a strong personal brand and following have clearly proven to be a thought leader/expert and have done a good job of getting individuals to follow them and tune into their content. In raising a 506(c) fund, they can 1) leverage that existing audience and 2) run a similar playbook to get LP capital committed in a similar approach to how they grew their personal brand. In Balaji’s case, he is a perfect example of someone who is active on social media and in public discussions as he regularly shares his thoughts on tech, politics, and society on platforms like Twitter & Substack.

GPs that are Good & Comfortable with Marketing & Branding → similar to above, if you are good and comfortable with public marketing and are comfortable converting your social capital into investable capital, then you can utilize channels like social media and advertising, but in this case for investor outreach. Operating or building a fund in the public eye is a key trait to a successful 506(c) raise.

Some examples of funds/GPs that have raised under the 506(c) structure include:

Weekend Fund (Ryan Hoover) → 250k Twitter followers

Sahil Lavingia ($5m fund from over 8k investors)

Backstage Capital (Arlan Hamilton raised $5m from over 7k investors)

Trust Fund (Sophia Amoruso has raised from over 750 LPs + has 100k+ Twitter followers)

RareBreed Ventures (Mac Conwell → 95k Twitter followers)

Notably, under either Rule 506(b) or 506(c), there is no limit on the number of accredited investors you can solicit, how much money you raise or how much each investor can invest. However, a fund’s size is generally constrained by the legal maximum number of investors. The number of limited partners a single fund can have is typically limited to 100 investors (or up to 250 investors if you have a sub-$10 million venture fund). There are also ways to leverage a fund so that you wall of your large investors in one fund (‘qualified purchasers’) and have up to 100 investors (or 250 investors) in your other parallel fund. Generally, a fund’s investor limits have nothing to do with using 506(b) or 506(c). And while it might be tempting to accept non-accredited investors, neither your lawyer nor your fund admin platform will accept them.

Some quotes on why fund managers decided to leverage 506(b) and do a “Community Raise”:

“I shouldn't be here. With the community raise, I'm able to share access to investing for people who aren't otherwise invited to invest in funds, or into the startups that Trust Fund will. I'm selecting LPs who bring strategic advantage to the portfolio, through deal flow, and to our portfolio companies through sharing their expertise and relationships, as well as amplifying the companies to their broader networks.”

Sophia Amoruso (Trust Fund)

“At Ganas Ventures, we chose to raise in public because we believe that the money we raise and use to invest in our community's founders will be most effective if it comes from firms and individuals who represent our population of underestimated and underrepresented founders and allies. These investors believe in our thesis, the power of community, and know that we can achieve outsized returns by punching above our weight with their support while also challenging the status quo. These are the limited partners we want to work hard for!”

Lolita Taub (Ganas Ventures)

“I raised publicly for two reasons:

SPEED: It let me go “inbound” rather than “outbound”. I have a big audience, so I was able to talk about the fund, and get inbound interest. I closed my whole fund without having to do a roadshow.

ACCESS: By opening it up to a broader audience, I was able to bring in people who would otherwise not have the access or skill to successfully angel invest in tech companies.”

Shaan Puri (All Access Fund)

“Timing, and lack of a warm network of LPs. When I started CapitalX, AngelList just publicly launched Rolling Funds for public raise. I didn't intentionally build a network of LPs over the years, so the idea of attracting LPs from all over the world was very promising - most of my LPs were "strangers" when they first invested in my fund.”

Cindy Bi (CapitalX)

506c Drawbacks

While the ability to raise in public, market, and access a wider investor pool all sounds great, it's important to consider some potential drawbacks of 506(c) funds:

Increased regulatory burden: While less stringent than SEC registration, 506(c) still requires compliance with certain regulations and disclosure requirements.

Potential investor scrutiny: Increased public exposure might attract additional scrutiny from investors, demanding more detailed due diligence and potentially longer fundraising timelines.

Every LP will need to provide proof of accreditation: Every LP in a 506(c) fund needs to provide proof of accreditation and the fund manager has to vet it, which can be annoying for some LPs as it provides another step in the process.

Legal and compliance expertise: Navigating the nuances of 506(c) regulations might require additional legal and compliance expertise compared to a 506(b) fund.

Summary of Drawbacks → Overall, raising capital under Rule 506(c) offers a compelling option for venture capital funds seeking broader investor reach, enhanced marketing opportunities, and greater flexibility compared to traditional private placements. However, it is important to carefully evaluate the potential regulatory burden and additional compliance requirements before embarking on this path.

So what does Balaji’s Fund mean for Venture Capital?

I think there are a number of items that are truly innovative to Venture Capital based on Balaji’s fund, however my focus on this newsletter is really the 506(c) structure.

Balaji & Jason Calacanis are the only 2 that I know of that are raising $50m+ funds via a 506(c) structure that aims to tap into a broader investor pool, including non-accredited investors. His aim to raise a significant amount of capital here really emphasizes that we are still in the early innings of democratizing venture capital or LP participation in venture capital. It also highlights the interest from smaller, non-institutional LPs to get into the asset class.

Today, most individual investors do not have access to be an LP in top tier funds. Their check sizes are just too small and they do not accommodate the masses of interested investors. Balaji’s fund allows LP’s to commit as little as $10k per quarter for 10-16 quarters.

Of course, it takes a lot of LPs to reach the fund size that Balaji strives to get to. Someone like Balaji is well-positioned for this though, because he has a big personal brand/following in addition to his track record. He is active on social media and in public discussions as he regularly shares his thoughts on tech, politics, and society on platforms like Twitter & Substack.

I believe Balaji’s Fund will open the doors to a new breed of investors interested in his thesis but also Venture Capital in general. Overall, Balaji’s fund represents a bold and innovative approach to venture capital, pushing boundaries and exploring new possibilities for social organization and governance. While the challenges are significant, it's certainly a noteworthy experiment (in my opinion) in the evolving world of technology and finance.

Which 506(c) Fund GP will be next?

Appendix → More on Balaji’s Fund

The Balaji Fund is led by Balaji S. Srinivasan (@balajis), an angel investor, tech founder and WSJ-best-selling author of The Network State. Formerly the CTO of Coinbase and General Partner at Andreessen Horowitz, Balaji was also the cofounder of Earn.com (acquired by Coinbase), Counsyl (acquired by Myriad), Teleport (acquired by Topia), and the nonprofit Coin Center. Dr. Srinivasan holds a BS/MS/PhD in Electrical Engineering and an MS in Chemical Engineering from Stanford, where he taught machine learning, computational biology, and a software MOOC that attracted more than 250,000 students worldwide.

Balaji has backed a wide variety of startups including Akasa, Alchemy, Benchling, Cameo, CoinTracker, Culdesac, Dapper Labs, Deel, Digital Ocean, Eight Sleep, EPNS, Farcaster, Gitcoin, Golden, Instadapp, Lambda School, Levels Health, Locals, Messari, Mirror, OnDeck, OpenSea, Orchid Health, Prospera, Replit, Republic, Roam Research, Skiff, Soylent, Stability AI, Starkware, Stedi, Superhuman, Synthesis, and Zora Labs, to name a few. Balaji was also an early investor in many important crypto protocols including Bitcoin, Ethereum, Solana, Avalanche, NEAR, Polygon, Chainlink, ZCash, and more.

This fund will scale up Balaji's seed investing across a wide variety of areas including, but not limited to, crypto/web3, deep learning, augmented reality and virtual reality, genomics, quantified self, autonomous robotics, network states, and frontier technologies more generally.

Fund Structure and Terms:

Fees: 2.5% management fees

Carry: 25% graduated to 30% after 3X returned

Commitment: $10K per quarter minimum, 10 quarter minimum

Carta exits secondary trading following credibility hit

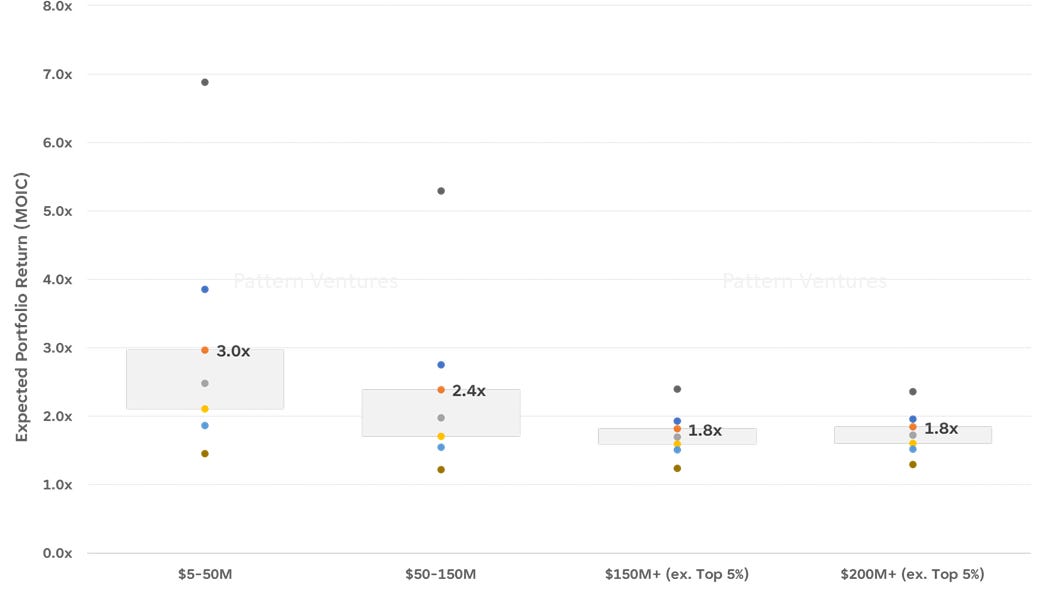

Pattern Ventures on the Appeal of Small Venture Funds

Ben Zises on the longest game founders will ever play

Last Money In is Powered by Sydecar

Sydecar is a frictionless deal execution platform for emerging venture investors. We make it easy for anyone to launch SPVs and funds in minutes, with automated banking, compliance, contracts, tax, and reporting so that customers can focus on making deals and building relationships.

How did you like this weeks topic? |

If you enjoyed this post, please share on LinkedIn, X (fka Twitter), Meta and elsewhere. It goes a long way to support us!

We’ll be back in your inbox next Wednesday on our next topic. Thanks for tuning in!

Questions? Comments? Feedback? We welcome all, and would love to hear from you!